The main focus of any new business is making its first profit. Business leaders will throw all their effort toward achieving this goal; however, there are other concerns facing a start-up. These problems aren’t anything to worry about if you know what to expect.

One of the core stages for any new business is the preparation stage. As such, here are a few extra things to keep in mind to prepare and protect your business.

Insurance

The first step that you take to protect the items you care about in your everyday life is to insure them, so why should your business be any different? Insurance protects your assets from theft, damage, or unforeseen accidents, and you may find it difficult to function with these assets out of commission. The right insurance can get you up and running again in no time, so you don’t lose out too much. However, business leaders have more on their plate than they may think.

A business operates on a much bigger scope than your everyday life. Therefore, you may discover that there are more ways to protect yourself with an insurance policy. For example, motor trade insurance is necessary for the upkeep of your business vehicles. Motor trade insurance deals can be easily found with Quotezone.co.uk. Even though the price of motor trade insurance fluctuates, the right policy can save your business if you hit a rough patch.

Cybersecurity

It is normal for new business leaders to misunderstand security protocols in the modern workplace. Most people of the age to lead a business were never taught to use a computer, so it is understandable if you are unfamiliar with cybersecurity terms like ransomware and firewalls. It is a good idea to get up to speed on these terms quickly though if you want to protect your business.

It is estimated that nearly 39% of businesses in the UK reported a cyber-attack in the last year alone. That is a significant portion of the country’s business infrastructure. However, those who implemented the correct cybersecurity protocols came out of these attacks unscathed. Cybercrime is a huge issue in modern business, so make sure you get up to speed on what you need to do to prepare.

Copyright

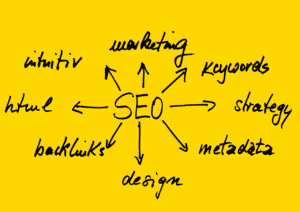

Insurance will protect your physical assets and cybersecurity will protect your company’s data. But how do you protect your intellectual property?

Intellectual property refers to any creative entity that you own. if you are operating a business, your intellectual property includes the product or service you offer and how you make money from that idea. A successful business idea is going to make money, so what is stopping other people from stealing this financially viable idea for themselves? There’s no way to own an imagined concept.

That is where copyright law comes in. These patents grant you creative ownership over your business, but you will need to seek the advice of a copyright lawyer to acquire these rights. It is difficult to find a source of ownership, so their advice can protect you against potential fraud. What’s more, this agreement ensures that you cannot be blamed for stealing another person’s idea.

Employee Contracts

As a business leader, you will start to recruit people to perform the tasks necessary for your business to function. Unfortunately, there are laws and regulations surrounding the hiring and management of an employee base that you must also brush up on.

A legal professional will be able to help you with these matters but drawing up an employment contract for every staff member on your payroll should prevent any lawsuits from coming your way. A contract should contain the details of the job, the hours they are expected to work and list any potential benefits you offer. After signing this, you can rest easy knowing that any future employee complications can be solved by referring to this legally binding document.

Investments

To start a new business, you will need a healthy sum of money to get your operation up and running. You can acquire this money by using your savings or applying for outside loans; however, it always helps to have a safety net in place.

Investors are experts in the field of business that will put their money forward to help fledgling businesses get off the ground. All they seek in return is a share of the profits once your company starts hitting certain profit margins. It can sting when you run out of money shortly into your first business venture, so try and seek out investors early. These professionals can provide you with an extra bit of start-up money, and they can also help you out if you face a particular obstacle. Be sure to reach out, so you are as prepared for success as possible.

Conclusion

There is no guarantee that your journey into business is going to work out. However, you can hedge your bets by protecting yourself with the information above.

Bio – An avid sports lover and creative writer, Jodie loves nothing more than sharing her insight into her favourite topics. As well as rugby and football, Jodie also enjoys writing about business and translating complicated corporate jargon into digestible and insightful content.